36+ Home loan tax saving calculator 2020

Get Your Estimate Today. The interest paid on a mortgage along with any points paid at closing are tax deductible if you itemize on your tax return.

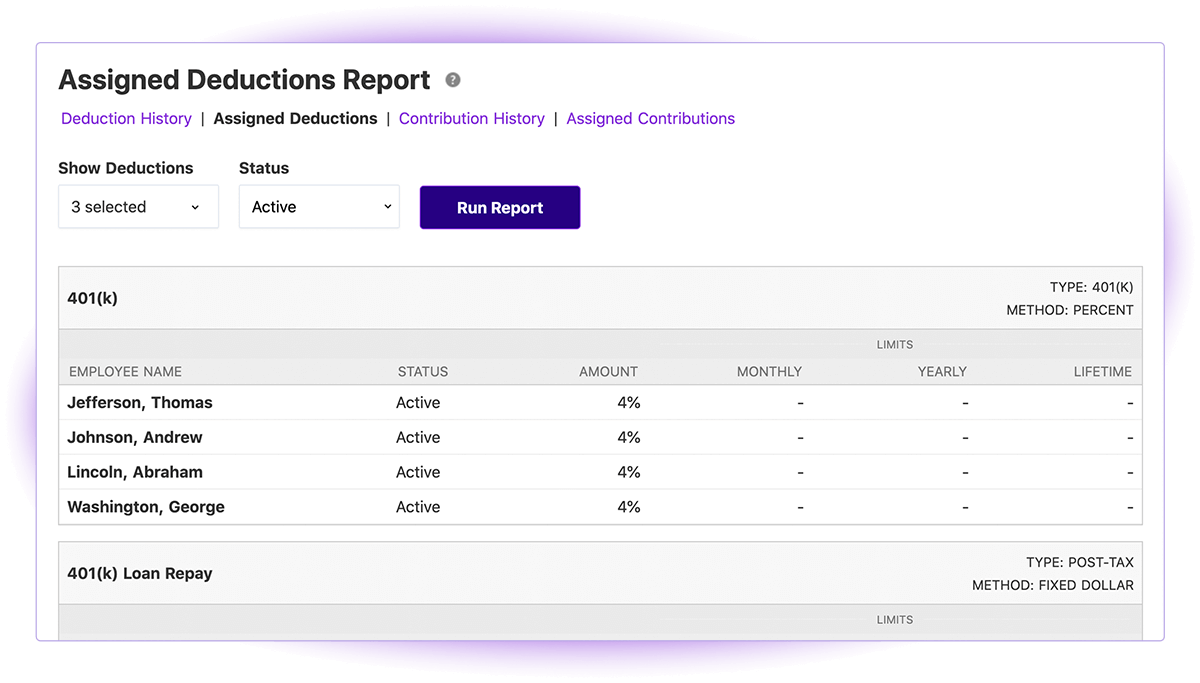

Payroll Software For Small Business Patriot Software

The calculator is simple and has an easy-to-use.

. As per the Income Tax Act of 1961 you can get annual home loan tax benefit via both the interest and principal components of the loan. The interest paid on a. How is tax exemption on Home Loan.

Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions. The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Use this calculator to see how this deduction can create a.

The interest paid on a. Ad Compare Mortgage Options Calculate Payments. 150000 on the principal repayment of a home loan.

Tax Saving Calculator can be used to get an estimate of the tax that can be saved by claiming the deductions available as per the applicable laws. Mortgage Tax Savings Calculator. Mortgage Tax Savings Calculator Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Call 800-236-8866 Monday-Friday 9 am-5 pm. Mortgage Tax Savings Calculator. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Ad Discover Helpful Information And Resources On Taxes From AARP. Ad Calculate Your Payment Fees More with a FHA Home Loan Expert. Get The Service You Deserve With The Mortgage Lender You Trust.

This tool estimates your average yearly tax savings on a mortgage loan and calculates your after-tax interest rate on the loan. Any interest paid on first or second mortgages over this amount is not tax deductible. Apply Now With Rocket Mortgage.

The interest paid on a. While a home loan tax benefit. Check tax benefits on home loans under section.

You can use the Home Loan Tax Saving Calculator on Bajaj MARKETS to calculate the total tax benefit that you can get on your home loan. Our calculator limits your interest deduction to the interest payment that would be paid on a. Ad Calculate Your Payment Fees More with a FHA Home Loan Expert.

302 504-6450 Click Here to Email Us. 6 Things Need to Know Before Getting a Fast Business Loan Whether its a business emergency or a fantastic opportunity in front of you you need access to capital now. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Under Section 80C of the Income Tax Act you can claim deductions of up to Rs. Tax benefits on home loans. CORE Financial Partners Middletown DE 19709 Toll Free.

See How Much You Can Save with Low Money Down Low Interest Rates. Under Section 24 you claim up to Rs. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

The main tax reliefs are listed under Section 80C and. See How Much You Can Save with Low Money Down Low Interest Rates. Tax benefits on home loans are available on both the principal amount and the interest amount in a financial year.

Ad Calculate Your Payment with 0 Down.

3

0c4t 7x6tpj1sm

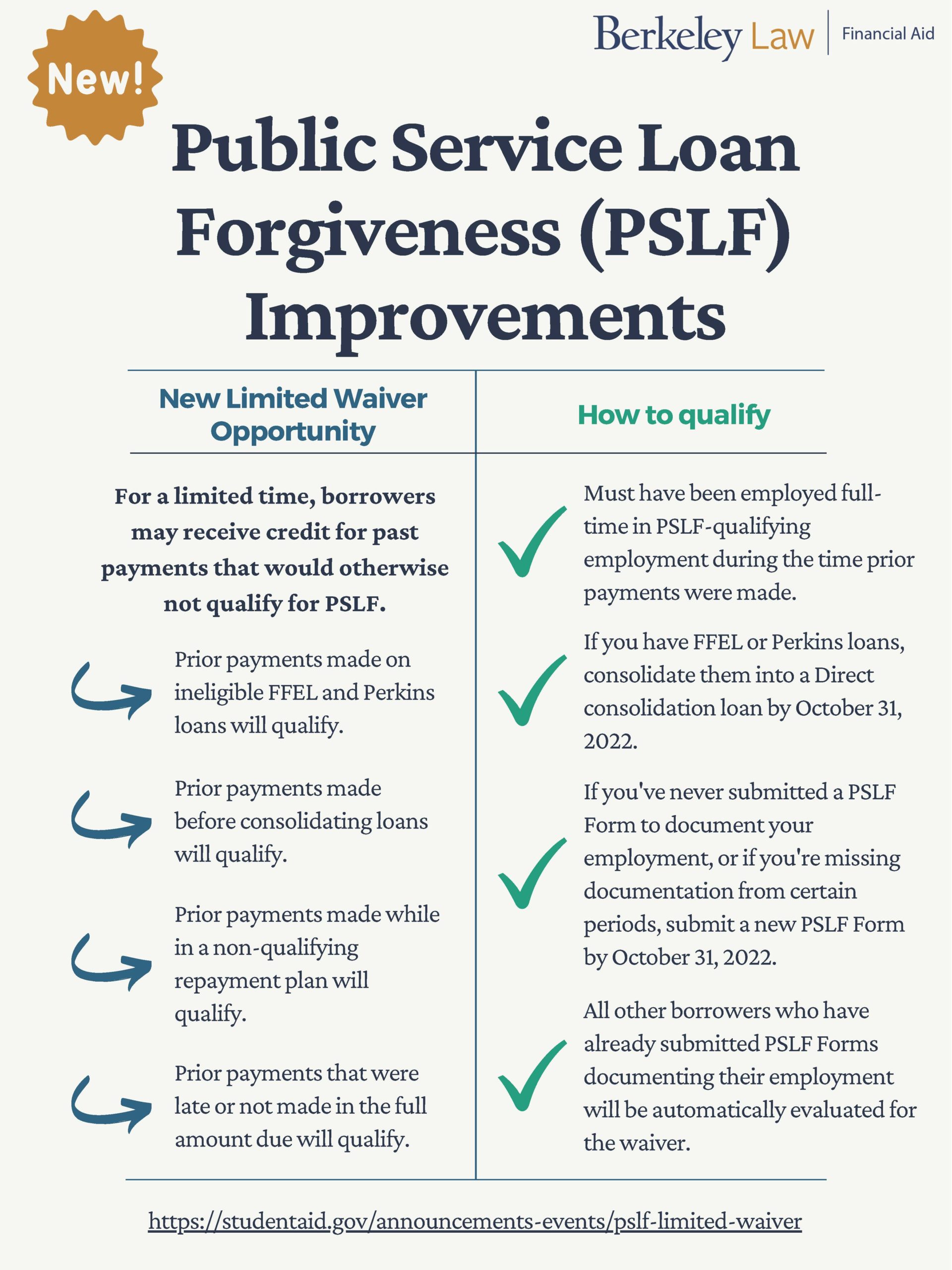

News Updates Berkeley Law

0pmohdeuq62lvm

36 Pinehurst Dr 36 East Haven Ct 06513 Mls 170520366 Redfin

Nri Income Tax Help Center Eztax

7c Squaw Village Road Moosehead Junction Twp Me

3

2

3800 Fire Walker Trl Cheyenne Wy 82001 Mls 86994 Zillow

2

Pin By Anireddy Swathi On Colors Exterior Paint Colors For House House Balcony Design Exterior House Paint Color Combinations

Sample Employee Payroll Report

3221 Dey Ave Cheyenne Wy 82001 Mls 87040 Zillow

1815 Black Bear Ct Cheyenne Wy 82009 Mls 87070 Zillow

36 Pinehurst Dr 36 East Haven Ct 06513 Mls 170520366 Redfin

1